ROOTED IN 25 YEARS OF SPECIALIST EUROPEAN REAL ESTATE KNOWLEDGE

WHY A FOCUS ON PROTECTING CAPITAL IS IMPERATIVE

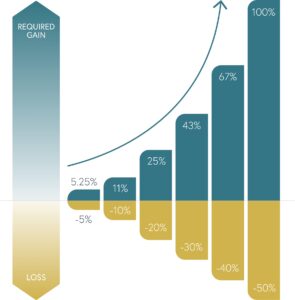

Protecting our clients’ interests is at the centre of everything we do. The percentage gains needed to recover from a loss greatly exceed the percentage of the decline. This is why shielding our clients’ capital from downside risk is important.

REQUIRED GAIN

5.25%

11%

25%

43%

67%

100%

LOSS

-5%

-10%

-20%

-30%

-40%

-50%

THREE WAYS TO INVEST WITH US DEPENDING ON YOUR RISK APPETITE AND AIMS.

FOR INVESTORS SEEKING ACCESS TO LOWER-RISK REAL ESTATE RETURNS

Our core, open-ended offering is the Europa Diversified Income Fund (EDIF)

Our core, open-end fund focuses on generating stable returns derived primarily from income. EDIF delivers exposure to the key real estate markets of western Europe and invests in assets with durable income streams.

Both core funds, EDIF and the Europa Student Generation Fund, were established in 2018, and they leverage our decades of experience driving consistent growth and net operating income.

More on CoreFOR INVESTORS WITH A HIGHER RISK TOLERANCE

Our non-core strategies

Our non-core strategies look to take advantage of mispriced risk in varying ways depending upon how different risk factors are priced at any point in the real estate cycle. We carefully select strategies that should deliver higher returns for our clients, understanding that the greatest potential for capital protection and growth is found at an asset-specific level by seeking mispriced risk.

The Europa advantage

By identifying where prices should be, and the narratives and constraints that have driven them to diverge, we can begin to identify mispriced risk to reveal attractive investment opportunities for our clients.

More on Non-CoreFOR INVESTORS SEEKING BESPOKE EUROPEAN REAL ESTATE STRATEGIES

We’re able to tailor-make separately managed accounts, bespoke mandates and co-investment or club programmes.

We have experience managing co-investments, joint ventures and separate accounts for investors seeking a more customised investment strategy. In recent years this has included the creation of a £267 million UK Build-to-rent residential portfolio and a €150 million European office development portfolio, as well as a UK office separate account.

Discuss your aims with usOUR FUNDS AT A GLANCE

We’re a specialist investment manager that places our clients and their clients at the centre of everything we do. For all products, our investors have a direct line to senior fund professionals, should they wish to discuss their strategies personally.